Bank Vision

To be a perpetual investment fund for Scotland that has a greater than £2 billion mission aligned investment portfolio demonstrating economic, societal and environmental returns. An established, regulated financial institution that is managing and leveraging third party capital having demonstrated a path to new markets and technologies.

The Scottish National Investment Bank plc (the Bank) provides investment to support growth in the Scottish economy by investing in innovation and accelerating the move to a net zero emissions, high tech, connected, globally competitive and inclusive economy. In addition to delivering mission impacts, the core principles of our investment strategy are:

- Investing in projects or businesses requiring up to £50 million of investment to support their growth or development.

- Investing through debt, fund or equity investment.

- Acting as a patient investor, providing long-dated investment to businesses and projects connected with Scotland.

- Generating commercial returns on our investments to support the Bank becoming financially self-sustaining.

- Reinvesting profit from the Bank’s investment activities and repaid capital to create a perpetual investment fund for the Bank’s Shareholder on behalf of the people of Scotland.

- Attracting private sector funds to co-invest alongside its public sector capital.

Mission Led Impact Investing

We are a mission-led impact investor. Our missions were set in 2020 by our Shareholder, Scottish Government Ministers, to address three grand challenges facing Scotland – the climate emergency, place-based opportunity, and demographic change and innovation deficit.

We recognise the complexity of the Grand Challenges and know that our investments alone will not deliver all the solutions required; solving these challenges requires coordinated action across the private, public and third sector drawing on both public and private finance to achieve the necessary scale and impact. We therefore work with a range of stakeholders to ensure our investments have high impact potential and where possible act as a catalyst for further investment and positive economic, societal and environmental change.

As an institution we value the relationships we build across our portfolio and where possible we will look to invest directly in businesses looking to scale. To increase the range and depth of impact we also invest indirectly in private sector funds, especially where fund managers are able to offer technical expertise or sectoral access that may be unavailable within the Bank.

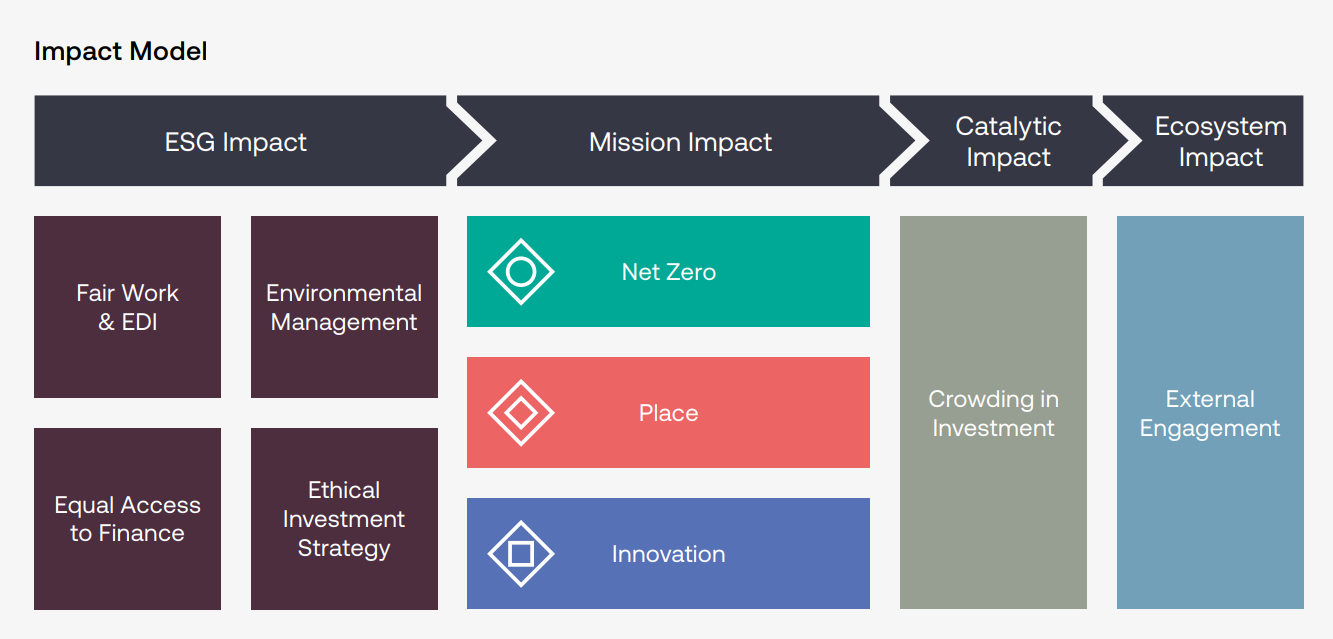

Impact Model

Through our investment activity we seek to enable impact in four distinct ways:

1. Delivery of our missions:

- Net Zero – Address the climate crisis, through growing a fair and sustainable economy.

- Place-Based Opportunity – Transform communities, making them places where everyone thrives.

- Innovation – Scale up innovation and technology, for a more competitive and productive economy.

In delivering our three defined investment missions, we integrate key principles to amplify our portfolio-level, positive impact in the Scottish ecosystem:

2. The promotion of a diverse and inclusive workforce through high-quality employment aligned to the ‘Fair Work First Principles’.

3. Increasing business understanding around carbon emissions and climate risk.

4. Creating equality of investment opportunity for people who are marginalised, minoritised, or under-represented.